The Only Guide for Hsmb Advisory Llc

The Only Guide for Hsmb Advisory Llc

Blog Article

Things about Hsmb Advisory Llc

Table of ContentsNot known Details About Hsmb Advisory Llc Hsmb Advisory Llc for Dummies10 Simple Techniques For Hsmb Advisory LlcIndicators on Hsmb Advisory Llc You Should Know

Life insurance policy is especially essential if your family members is reliant on your salary. Industry professionals suggest a plan that pays out 10 times your annual earnings. These might include home mortgage payments, outstanding lendings, debt card financial debt, taxes, child care, and future university prices.Bureau of Labor Statistics, both spouses worked and brought in income in 48. They would certainly be likely to experience financial hardship as an outcome of one of their wage income earners' fatalities., or personal insurance coverage you acquire for on your own and your family members by calling health and wellness insurance business straight or going through a health insurance policy agent.

2% of the American populace was without insurance protection in 2021, the Centers for Disease Control (CDC) reported in its National Center for Health And Wellness Statistics. More than 60% got their protection with a company or in the personal insurance market while the remainder were covered by government-subsidized programs consisting of Medicare and Medicaid, veterans' benefits programs, and the government marketplace developed under the Affordable Treatment Act.

The Best Guide To Hsmb Advisory Llc

If your revenue is reduced, you might be one of the 80 million Americans who are eligible for Medicaid.

Investopedia/ Jake Shi Long-term special needs insurance coverage sustains those that come to be unable to work. According to the Social Safety and security Administration, one in 4 employees getting in the workforce will certainly come to be handicapped before they get to the age of retired life. While medical insurance pays for a hospital stay and medical expenses, you are usually burdened with all of the expenditures that your income had actually covered.

Many policies pay 40% to 70% of your revenue. The price of special needs insurance coverage is based on several variables, consisting of age, lifestyle, and wellness.

Several plans need a three-month waiting period prior to the coverage kicks in, supply an optimum of 3 years' worth of protection, and have significant plan exemptions. Right here are your alternatives when purchasing automobile insurance coverage: Responsibility insurance coverage: Pays for residential property damage and injuries you cause to others if you're at fault for a crash and also covers litigation prices and judgments or negotiations if you're filed a claim against because of a cars and truck accident.

Comprehensive insurance coverage covers theft and damage to your auto because of floodings, hailstorm, fire, vandalism, falling objects, and pet strikes. When you finance your cars and truck or rent a cars and truck, this kind of insurance policy is obligatory. Uninsured/underinsured motorist (UM) insurance coverage: If an uninsured or underinsured vehicle driver strikes your car, this insurance coverage pays for you and your guest's medical expenditures and may additionally make up lost earnings or make up for pain and suffering.

Employer insurance coverage is typically the most effective option, however if that is inaccessible, acquire quotes from several providers as several offer discount rates if you purchase even more than one kind of coverage. (https://www.mixcloud.com/hsmbadvisory/)

Hsmb Advisory Llc Can Be Fun For Everyone

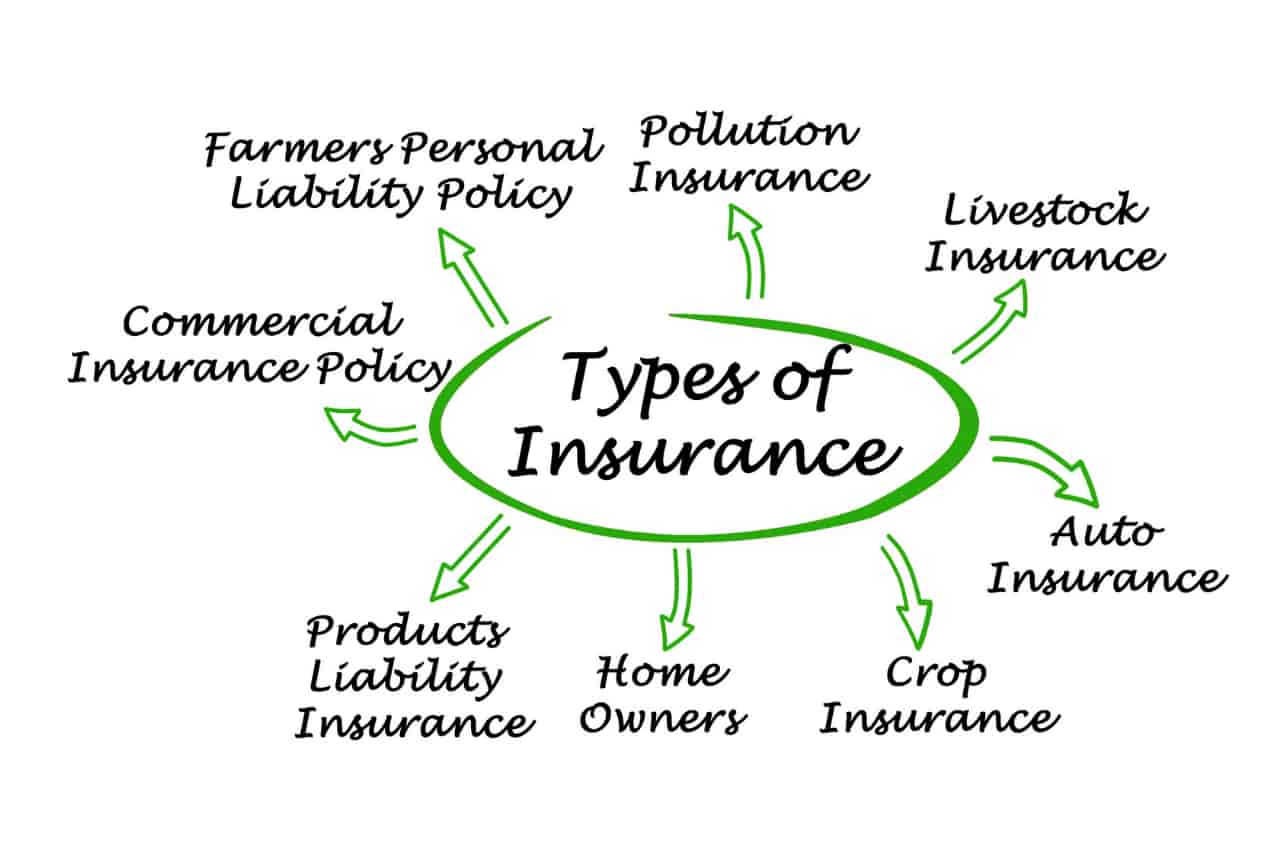

Between wellness insurance, life insurance policy, special needs, responsibility, long-term, and also laptop insurance coverage, the task of covering yourselfand considering the endless opportunities of what can take place in lifecan really feel frustrating. When you recognize the principles and make certain you're sufficiently covered, insurance policy can boost economic self-confidence and health. Right here are the most vital sorts of insurance coverage you require and what they do, plus a couple suggestions to avoid overinsuring.

Various states have different guidelines, yet you can expect medical insurance (which many individuals make it through their company), automobile insurance coverage (if you have or drive a car), and homeowners insurance coverage (if you own residential property) to be on the list (https://fliphtml5.com/homepage/nntoi/hsmbadvisory/). Mandatory kinds of insurance coverage can alter, so check out the most up to date regulations once in a while, especially before you renew your plans

Report this page